- STOCK SYMBOL GENERATOR ALGORITHM SOFTWARE

- STOCK SYMBOL GENERATOR ALGORITHM CODE

- STOCK SYMBOL GENERATOR ALGORITHM SERIES

The portfolio is designed to "go long" (buy) 500 shares of SPY at the opening price if the signal states that an up-day will occur and then sell at the close. This portfolio object differs from the example given in the Moving Average Crossover backtest article as it carries out trading on an intraday basis. Now that the forecasting engine has produced the signals, we can create a MarketIntradayPortfolio. # Remove the first five signal entries to eliminate # Predict the subsequent period with the QDA model To go long, short or hold (1, -1 or 0)."""

"""Returns the DataFrame of symbols containing the signals # Create the Quadratic Discriminant Analysis model # predictor values, with direction as the response

Snpret = create_lagged_series(self.symbol, self.start_train,

STOCK SYMBOL GENERATOR ALGORITHM SERIES

# Create a lagged series of the S&P500 US stock market index US stock market index (^GPSC in Yahoo).""" """Fits a Quadratic Discriminant Analyser to the Self.start_test = datetime.datetime(2005,1,1) Self.start_train = datetime.datetime(2001,1,10) Symbol - A stock symbol on which to form a strategy on.īars - A DataFrame of bars for the above symbol."""

STOCK SYMBOL GENERATOR ALGORITHM CODE

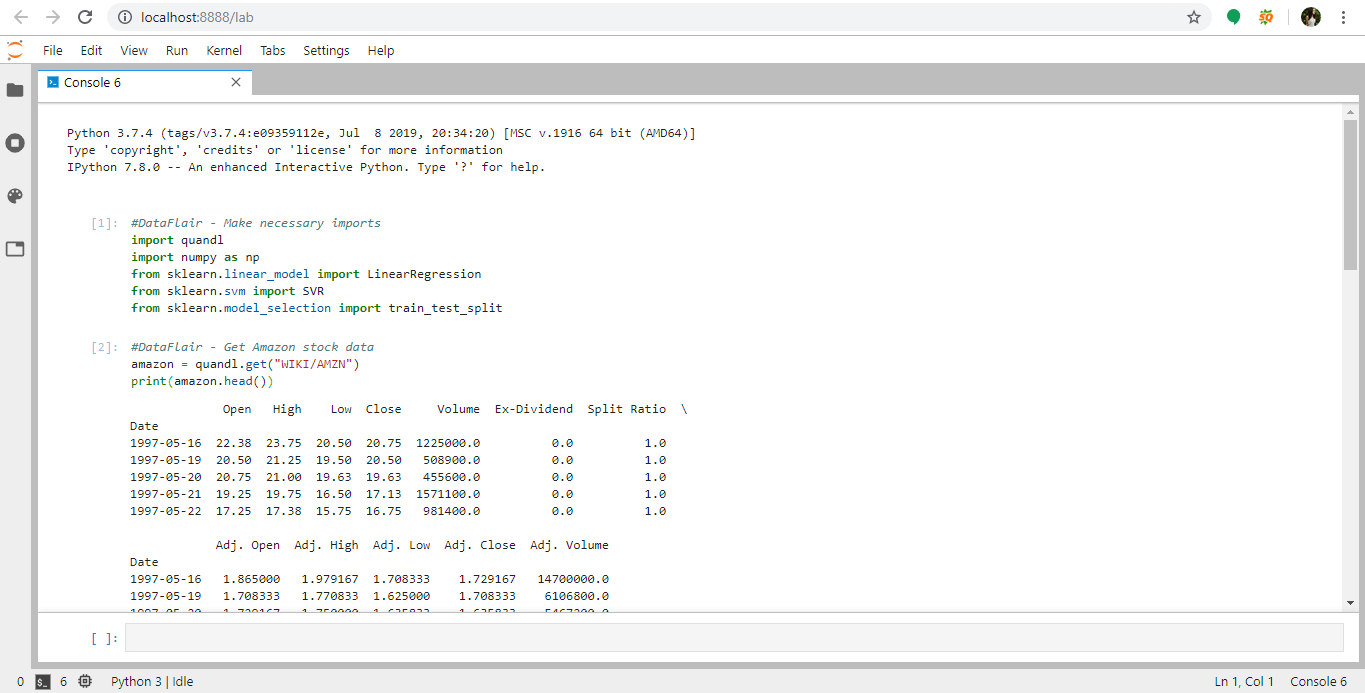

The comments in the source code below discuss extensively what the program is doing: # snp_forecast.py The details of how a quadratic discriminant analyser works, as well as the Python implementation below, is described in detail in the previous article on forecasting of financial time series. This matches the interface of a Strategy class. The fitting of the model is carried out in the fit_model method below, while the actual signals are generated from the generate_signals method. SNPForecastingStrategy is designed to fit a Quadratic Discriminant Analyser to the S&P500 stock index as a means of predicting its future value. Once all of the relevant libraries and modules have been included it is time to subclass the Strategy abstract base class, as we have carried out in previous tutorials. The first step is to import the necessary modules and objects: # snp_forecast.pyįrom forecast import create_lagged_series In addition forecast.py (which mainly contains the function create_lagged_series) is created from this previous tutorial. The implementation of snp_forecast.py below requires backtest.py from this previous tutorial. ImplementationĪs with the other Python/pandas related tutorials I have used the following libraries: Thus our forecaster needs to be relatively accurate at predicting daily returns, otherwise transaction costs will eat all of our trading returns.

These would likely be a substantial percentage of the returns as there is a round-trip trade carried out every day. In addition we have not included transaction costs. Note that this is not a particularly realistic trading strategy! We are unlikely to ever achieve an opening or closing price due to many factors such as excessive opening volatility, order routing by the brokerage and potential liquidity issues around the open/close. Thus it is our first example of an intraday trading strategy. if the probability of a down day exceeds 50%, the strategy sells 500 shares of the SPY ETF and then buys back at the close. If the probability of the day being "up" exceeds 50%, the strategy purchases 500 shares of the SPY ETF and sells it at the end of the day. The forecaster uses the previous two daily returns as a set of factors to predict todays direction of the stock market. Both of these models are described in detail within the article on forecasting of financial time series. The forecasting strategy itself is based on a machine learning technique known as a quadratic discriminant analyser, which is closely related to a linear discriminant analyser. Mature Python libraries such as matplotlib, pandas and scikit-learn also reduce the necessity to write boilerplate code or come up with our own implementations of well known algorithms. The nature of object-oriented programming means that the code we write subsequently can be kept short as the "heavy lifting" is carried out on classes we have already developed.

STOCK SYMBOL GENERATOR ALGORITHM SOFTWARE

This article will build heavily on the software we have already developed in the articles mentioned above, including the object-oriented backtesting engine and the forecasting signal generator. We are now going to combine all of these previous tools to backtest a financial forecasting algorithm for the S&P500 US stock market index by trading on the SPY ETF. Recently on QuantStart we've discussed machine learning, forecasting, backtesting design and backtesting implementation.

0 kommentar(er)

0 kommentar(er)